car lease tax write off

When using the actual cost method to write off a car lease you can deduct your monthly sales tax. Those who opt for the.

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Write Off Car With Section 179 Vehicle Tax Deduction Now if youre trying to get a vehicle for free then you want to take advantage of accelerated depreciation through the tax.

. The so-called SALT deduction. You must choose either sales tax or income taxes to deduct. Many people incorrectly assume that car write-offs only extend to cars that you own but the IRS has never made that distinction.

Kristin Disbrow CPA Kristin Meador is a. If you are using a leased car for business you can deduct a portion of your expenses. Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the.

When you lease a car the leasing company pays the sales tax on the vehicle which could save you hundreds of dollars depending on the state in which you live. However provided at least half of the cars. If you lease a new vehicle for 400 a.

If youre using the actual cost method to write off your car lease you deduct your monthly sales tax on a separate line on your business tax return. Buying a Business Vehicle that is more than 6000 Pounds is an excellent Tax Write Off. For example if my car is deemed to be 60 business use and my lease payment is 500 I can claim 300 per month as a write-off.

The IRS includes car leases on their list of eligible vehicle tax deductions. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes. To get a depreciation or Section 179 deduction you must use your car more than 50 of the time for business driving.

If youre a self-employed person or a business owner who drives for work your lease is fair game. As a small business owner you are always looking for ways to lower your taxes. A leased car driven 9000 miles for business equates to a 5175 deduction 12000 miles 3000 personal and commuting miles 0575 IRS mileage rate.

For example if you consider leasing a car for 350mo versus purchasing a used one for 20000 with financing you would have to choose from the following options on your. According to the IRS you can include gas oil repairs. How to deduct lease payments.

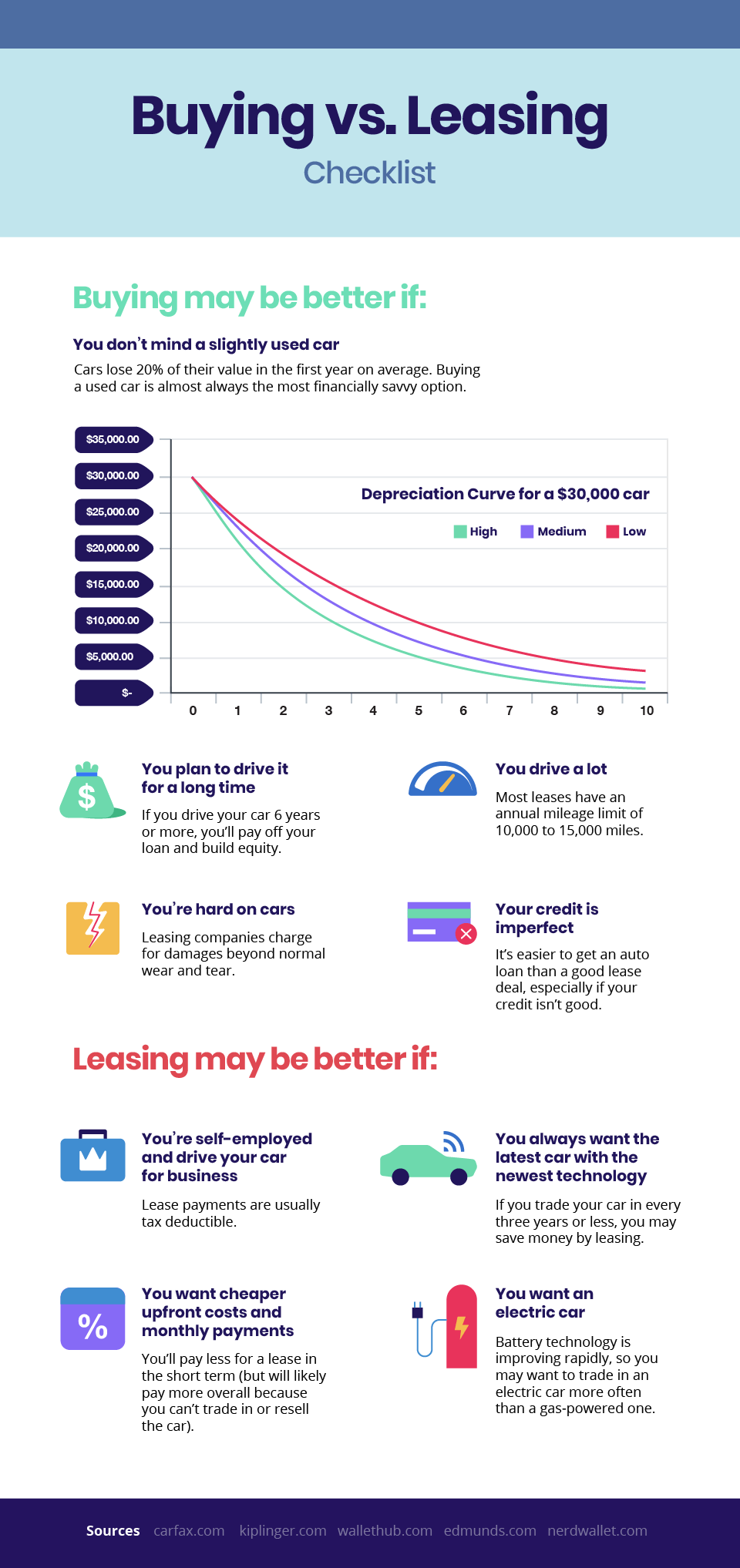

Buy -- depends largely on how much you plan to drive and the type of car you want. When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. Deducting sales tax on a car lease.

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of. Since most leased company cars have some degree of personal use you wont always be able to claim back the full amount of tax. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

If a taxpayer uses the car for both. So if you have a 50000 car with 100 business use 50000 divided by five years is a 10000 tax write-off every year. In addition if youre leasing a.

If your business is a sole. Learn which car lease tax write-off method offers the highest deduction. Tax professional Hans Kasper.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. You can write off work-related expenses by either deducting the standard mileage rate or by deducting actual expenses. This comes on a separate line on the business tax return.

If you lease a car that you use in your business you can deduct your car expenses using the standard mileage rate or the actual expense method. Which plan works better for you -- and whether or not to lease vs. Can you write off a car lease.

If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Lease A Car With No Credit Bankrate

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Are Car Lease Payments Tax Deductible Lease Fetcher

Are Car Lease Payments Tax Deductible Lease Fetcher

New Business Vehicle Tax Deduction Buy Vs Lease Windes

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is Leasing A Car Tax Deductible Money Donut

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Implications Of Business Car Leasing Company Car Lease Tax

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog